Tax Software 2016 Mac Os X

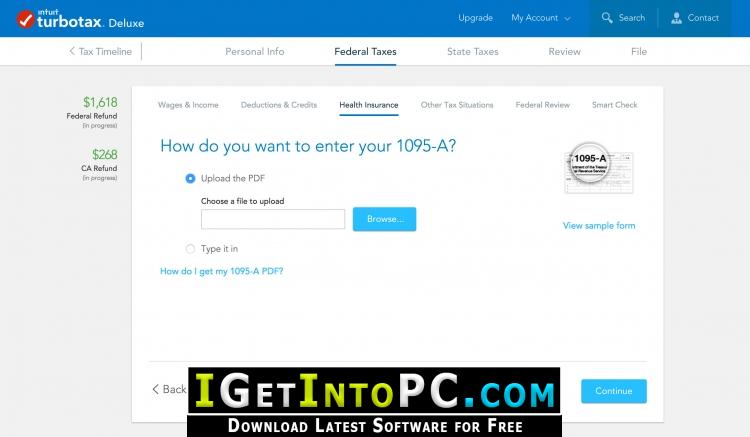

TURBOTAX ONLINE/MOBILE. Best free photo resizer software. Try for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. $0 federal (for simple tax returns) + $0 state + $0 to file offer only available with TurboTax Free Edition; offer may change or end at any time without notice. Actual prices are determined at the time of print or e-file and are subject to change.

- Intuit TurboTax (Deluxe / Premier / Home & Business) 2016 (MacOSX) 406.46 MBTurboTax Home & Business - Personal & Self-Employed. Well tell you which expenses you can deduct such as phone, supplies, utilities, home office and more. Dont miss any tax write-offswell help you spot.

- This software for Mac OS X is a product of TaxTron Inc. The file size of the latest setup package available for download is 45.5 MB. This Mac download was checked by our antivirus and was rated as virus free.

- Free download OnePriceTaxes Tax Software OnePriceTaxes Tax Software for Mac OS X. OnePriceTaxes tax software allows you to file your individual federal and state income tax return with the IRS and your state all for one low price.

TaxTron Individual License for Macintosh

Completely FREE To start for the current tax year! You can prepare up to 20 returns using the software but you may need to purchase a license to print and/or file your return depending on your situation.

Our 2019 tax preparation software does not require a license for returns under $31,000 total income (including seniors) or full-time students (4 months or more duration as indicated on your T2202A form).

TaxTron Individual License for Macintosh allows you to prepare and file one return with a total income of $31,000 or more and 19 other returns with a total income of under $31,000 each.

Previous years’ software requires a license to print and/or file any return.

Electronic filing: is only supported for 2016, 2017, 2018 and 2019 tax years for Canada Revenue and 2016, 2017, 2018 and 2019 tax years for Revenue Quebec. For all other years you will be able to prepare and print the tax returns for paper submission.

System Requirements:

- TaxTron 2019 requires Mac OS 10.9 or higher. This product will NOT work on OS 10.8 or lower

- TaxTron 2017 and 2018 requires Mac OS 10.9 to Mac OS 10.14. This product will NOT work on OS 10.8 or lower

- TaxTron 2011 to 2016 requires Mac OS 10.7 to Mac OS 10.12

Need more than one return over $31,000? Check our product list for theFamily Pack!

Get the Windows Version Get the Mac VersionTaxTron ExclusionsTaxTron Features and Benefits

No Multi-Tier Software

TaxTron’s software package contains virtually all the forms you will possibly need, in order to file your personal tax return. No additional or hidden fees! Have peace of mind - whether you have investments or just filing a T4 - you will be charged the same low price, every time.

Inexpensive

TaxTron is competitively priced against our competitors and many returns can actually be filed for free. TaxTron is free for individuals filing a T1 or TP1 return with incomes under $31,000 as well as students with 4 months or more on their T2202 forms.

Mac Os X Versions

Easy to Use Yet Powerful

TaxTron has built-in guides right in our software - so, a complete novice will be able to fill out their taxes quickly just like a pro! If you’re a professional, TaxTron’s Form Mode allows you to dive straight into the tax forms directly, helping you prepare tax returns in as little as 10 minutes or less.

Go Modern

TaxTron’s software is built with the future in mind. You can Netfile your personal tax return with Canada Revenue and Revenue Quebec straight from our software. You can also print your tax return for your own records or submit it to the government via mail.

Experienced

TaxTron has been helping Canadians prepare their own tax returns for over 20 years. TaxTron was the first available tax software for Macintosh computers, and one of the first to support electronic filing of returns - making us your best choice in Canadian tax software!

Mac Os X Download

Not Your First Time?

TaxTron can roll information forward from last year’s return if you prepared your return last year using TaxTron, saving you time and effort in getting this year’s taxes done. Whether it’s your tuition amount, RRSP limits, or something as simple as name and address, TaxTron will copy that information over so you will minimize potential errors.

TaxTron Family License for Macintosh

TaxTron Tax software for Families is for Canadian taxpayers who are either helping family members file their tax returns or are needing different licenses for each taxpayer in the household wanting to do their taxes on their own.

Our 2019 tax preparation software does not require a license for returns under $31,000 total income (including seniors) or full-time students (4 months or more duration as indicated on your T2202A form).

TaxTron Family License for Macintosh allows you to prepare and file five returns with a total income of $31,000 and more and 15 other returns with a total income of under $31,000 each.

Previous years’ software requires a license to print and/or file any return.

Electronic filing: is only supported for 2016, 2017, 2018 and 2019 tax years for Canada Revenue and for 2016, 2017, 2018 and 2019 tax years for Revenue Quebec. For all other years you will be able to prepare and print the tax returns for paper submission.

System Requirements:

- TaxTron 2019 requires Mac OS 10.9 or higher. This product will NOT work on OS 10.8 or lower

- TaxTron 2017 and 2018 requires Mac OS 10.9 to 10.14 or higher. This product will NOT work on OS 10.8 or lower

- TaxTron 2011 to 2016 requires Mac OS 10.9 to 10.12

Only need one more return over $31,000? Check our product list for the Individual License!

Get the Windows Version Get the Mac VersionTaxTron ExclusionsTaxTron Tax Software for Families

No Multi-Tier Software

TaxTron’s software package contains virtually all of the forms you may ever need to file your personal tax return. No additional or hidden fees! Have peace of mind knowing that whether you have investments or just filing a T4, you will be charged the same low price.

Inexpensive

TaxTron is competitively priced and many returns can actually be filed for free. TaxTron is free for individuals filing a T1 or TP1 return with incomes under $31,000, as well as students with 4 months or more on their T2202 forms.

Easy to Use Yet Powerful

TaxTron has built-in guides right in our software - so a complete novice will be able to fill out their taxes quickly, just like a pro! If you’re a professional, TaxTron’s Form Mode allows you to dive straight into the tax forms directly, helping you prepare tax returns in as little as 10 minutes or less.

Go Modern

TaxTron’s software is built with the future in mind. You can Netfile your personal tax return with Canada Revenue and Revenue Quebec straight from our software. You can also print your tax return for your own records or submit it to the government via mail.

Experienced

TaxTron has been helping Canadians prepare their own tax returns for over 20 years. TaxTron was the first available tax software for Macintosh computers, and one of the first to support electronic filing of returns. This makes us your best choice in Canadian tax software.

Not Your First Time?

TaxTron can roll information forward from last year’s return if you prepared your return last year using TaxTron - saving you time and effort in getting this year’s taxes done. Whether it’s your tuition amount, RRSP limits, or something as simple as name and address, TaxTron will copy that information over so you will be cutting down on any errors.